Global markets were mixed this week, with US stocks slipping on AI worries, Europe steady, and Asia buoyed by Japan’s election and modest Chinese gains.

United States

US stocks fell over the week amid growing concerns about the disruptive potential of artificial intelligence (AI). The Nasdaq Composite was the weakest performer, down 2.1%, while the S&P 500 and Dow Jones Industrial Average declined 1.4% and 1.2%, respectively. Mid-cap stocks proved more resilient, with the S&P MidCap 400 losing 0.7%. The Russell 1000 Value Index continued to outperform growth, extending its year-to-date lead to 11.0 percentage points.

January’s jobs report provided a positive surprise, with US employers adding 130,000 positions, the highest monthly gain in over a year, lowering the unemployment rate to 4.3%. Job gains were strongest in health care, social assistance, and construction. Despite this, downward revisions to prior years’ figures, including 2025’s total job creation slashed from 584,000 to 181,000, tempered the overall picture. Strong employment data pushed expectations for an early rate cut lower, with the probability of unchanged Federal Reserve rates through June rising above 40%.

Meanwhile, consumer inflation eased in January, with the CPI up 0.2% month-on-month and 2.4% year-on-year, aided by falling energy prices. Core inflation rose 0.3% for the month, in line with forecasts. Retail sales stalled in December, remaining flat and missing the expected 0.4% gain. US Treasuries delivered positive returns, with yields falling, while investment-grade corporate bonds lagged slightly and high-yield bonds held firm.

Europe

European markets were mixed as investors digested US jobs data and AI-related concerns. The pan-European STOXX Europe 600 ended broadly flat, rising 0.1%. Germany’s DAX rose 0.8%, France’s CAC 40 gained 0.5%, the UK’s FTSE 100 added 0.7%, and Italy’s FTSE MIB fell 1.0%.

The eurozone economy expanded 0.3% in Q4 2025, with Spain leading at 0.8% growth. Employment in the region rose 0.2%, exceeding expectations, though France’s unemployment climbed to 7.9%, with youth unemployment at 21.5%. German wholesale prices increased 1.2% year-on-year, driven by metals, food, and beverages. In the UK, political uncertainty weighed on sentiment, though Q4 GDP rose 0.1% and retail sales advanced 2.3% year-on-year in January.

Japan

Japan’s stock markets surged following the LDP’s decisive lower house election win. The Nikkei 225 rose 5.0% and the TOPIX 3.2%, supported by expectations for increased fiscal spending and potential constitutional reform. JGB yields remained largely unchanged at 1.23%, while the yen strengthened to JPY 153 against the dollar following government intervention. Real wages fell 0.1% year-on-year in December.

China

Chinese equities rose modestly ahead of the Lunar New Year, with the CSI 300 up 0.4% and the Shanghai Composite 0.4%, while Hong Kong’s Hang Seng was flat. Consumer inflation eased to 0.2% year-on-year in January, with producer prices in deflation for a 40th month. Resale home prices showed tentative stabilisation. The PBOC reaffirmed a “moderately loose” monetary stance, signalling potential rate and reserve requirement cuts.

Other Key Markets

In Latin America, Argentina’s monthly inflation surged to 2.9%, lifting annual inflation to 32.4%. Brazil saw month-on-month inflation of 0.33% in January, keeping the annual rate within the central bank’s target at 4.44%.

Major Company News:

Stellantis takes a $26bn charge, scrapping some EV models and reviving V8 and diesel engines, hitting shares by $6bn amid a US climate policy-driven EV strategy reset.

Getir co-founders sue Mubadala for $700mn, claiming promised assets, including Getir Finance, were withheld during 2024 restructuring. The case follows Mubadala’s sale of Turkey’s food delivery business to Uber.

Uber expands delivery into seven new European countries in 2026, targeting $1bn extra bookings and taking on rivals such as Wolt, aiming to “shake things up” in the market.

UK asset manager Schroders agrees to £9.9bn takeover by US rival Nuveen, reflecting pressure from low-cost passive investing and industry consolidation over the past decade.

OpenAI hires Peter Steinberger of OpenClaw to boost autonomous AI, enabling agents to manage apps, emails, and calendars, expanding personal and business AI productivity tools.

Weekly Update

16th February 2026

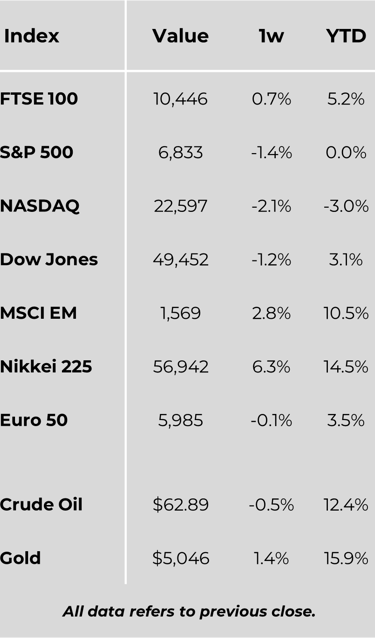

Markets Data

This publication is intended to be Hexagon Wealth’s own commentary on markets for clients. Hexagon Wealth Limited is authorised and regulated by the Financial Conduct Authority. FCA number 483403. Hexagon Wealth Limited is registered in England and Wales under company number 04503414. Whilst Hexagon Wealth uses reasonable efforts to obtain information from sources which it believes to be reliable, it makes no representation that the information or opinions contained in this document are accurate, reliable or complete and will not be liable for any errors, nor for any actions taken in reliance thereon. Such information and opinions are subject to change without notice. We expect readers to rely on their personal views on the subject when reading the opinions expressed above and contact their financial adviser before taking any action. It is not investment research and should not be construed as an offer or solicitation to buy, sell or trade in any of the investments, sectors or asset classes mentioned. The value of any investment and the income arising from it is not guaranteed and can fall as well as rise, so that you may not get back the amount you originally invested. Past performance is not a reliable indicator of future results. Movements in exchange rates can have an adverse effect on the value, price or income of any non-sterling denominated investment. Nothing in this document constitutes advice to undertake a transaction, and if you require professional advice please contact your financial adviser.